Reporting Digital Assets

In reference to the newsletter from last week, I decided to take my own suggestion and reserved four rooms at the Super 8 hotel in Waco for the period of April 7-9. I intend to share them with friends and family. I might need a room myself if the owner of my Air B&B for the eclipse decides to back out of our agreement, which I’ve heard is quite common. Waco appears to be fully booked at this time. Nevertheless, don’t give up just yet. Some hotels release their availability less than a year ahead of time. I suspect many places will make their rooms for April 2024 available on April 30 of this year. Therefore,

keep an eye out for new openings. The path of the eclipse will also be visible across a large portion of Mexico, extending all the way to Maine and into various areas of Canada. Last week, I also discussed the ticket sale for Burning Man. Sadly, for the third consecutive time, I was unable to secure a ticket. I found myself staring at the same loading screen on three different computers for an exhausting 80 minutes before it

I knew others who were trying for tickets too, and one of them managed to get through. In the meantime, I will be quite friendly with my fellow Vegas attendees, hoping to snag a last-minute ticket as the event draws nearer. suddenly said the sale was over.

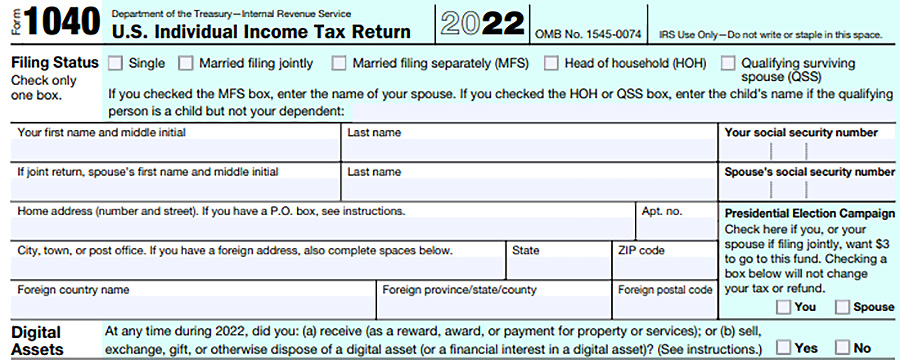

For those in the U.S. who tend to put things off, let me talk about your requirements tied to “digital assets.” Right at the top of the 1040 tax form, just below where you fill in your address, there’s a question asking if you possessed any digital assets at any time during 2022. somebody who gets cold feet.

If you answer affirmatively, you will need to report any income generated from the sale of these digital assets. This information is required on

At the very least, you will have to supply the date and the value of the assets when they were acquired and when they were sold. In cases with many transactions, keep in mind that it’s a “first in – first out” approach to decide when an asset was initially acquired. For those who have dealt with numerous trades, I can imagine that this form might be quite a hassle. form 8949. To complicate things further, if at any point in 2022 you had more than $10,000 in a single account or wallet, you must disclose these accounts using the FBAR form (Foreign Bank and Financial Accounts Report).

It might be tempting to simply answer “no” to the initial query. However, it seems that wallets registered in the U.S., such as Coinbase, are obliged to report any profits to the IRS. As for wallets based outside the

U.S., my financial advisor has informed me that the government is pursuing those records and has the ability to obtain them. I am not here to instruct anyone on what course of action to take. I simply hope to have presented the advantages and disadvantages from both perspectives accurately.

Until we connect again next week, may fortune smile upon you.

Accurate mathematical strategies and insights for various casino games like blackjack, craps, roulette, and numerous others that can be enjoyed.