On this page

Bet as an Entity!

Cut Out the Middleman (Yourself)

Betting on sports can seem overwhelming for many individuals. For starters, you have to meticulously analyze betting lines to find favorable odds, conduct thorough research about teams and players' performances, and compare lines across various sportsbooks in Nevada. Additionally, if you are located outside the state, finding someone trustworthy to place bets on your behalf can be a challenge. However, Nevada's recent initiative known as 'Entity Betting' aims to simplify this process by taking the responsibility of decision-making and financial transactions out of your hands. But is that necessarily a negative change?

In 2015, Nevada passed Senate Bill No. 443, which opened the door for external 'Investors' to engage in sports betting by funneling their money towards designated 'Entities.' These Entities are treated as investment opportunities. You can find more details about the bill here:

https://www.leg.state.nv.us/Session/78th2015/Bills/SB/SB443_EN.pdf

These 'Entities' function primarily as investment firms, allowing individuals from other states to channel their funds into sports betting activities within Nevada's sportsbooks. This setup remains compliant with the law since Nevada prohibits betting from out-of-state individuals unless they are physically present. Investors do not have any say in the betting decisions made by the Sports Entities.

Essentially, when you invest, you face two layers of fees. The first is the commission charged by the sportsbook, which takes a percentage of the total bets based on their lines. The second fee comes from the Entity itself, which might charge commissions or fees that could depend on the bet's outcome, according to the agreement with the Investor. This could prove challenging for some, as even if the Entity wins more often than not, the Investor will only receive a fraction of the profits because the Entity needs to earn its share. However, if the Entity has a consistent track record of profitability, the chances of incurring losses are relatively low.

For those interested in exploring available Entities, WagerTraders.com is a useful resource, presented below:

I also had the opportunity to sit down for an interview with Todd, the owner of WagerTraders.com, which will be included later in this article:

Various Entities operate under distinct agreements with their Investors, one notable example being the Nevada Sports Investment Group (NSIG). This fund is well-recognized and has been highlighted in numerous national media outlets. It requires a minimum investment of $25,000, which might be too high for some, but it does allow Investors to withdraw their funds at any time, unlike many others that tie up the investment for a specific duration.

NSIG confirms that the Investor retains 70% of the profits while the Entity takes a 30% 'Management Fee.' Moreover, they employ a statistics-based and data-informed strategy when placing their bets.

The significance of that 30% cut shouldn't be overlooked, as there remains a risk of the Entity losing money, particularly in the short run, even when making sound betting choices. It's worth noting that if the Entity earns a substantial profit, the amount you'll owe them in fees will also increase. To ascertain whether investing with this Entity is beneficial, one must analyze the projected earnings against the risk of losses. Even if the Entity appears likely to generate some profits, that needs to be weighed against the possibility of losing a portion or all of your investment.

Ken Murphy of NSIG Interview

I had the pleasure of conducting an exclusive phone interview with Ken Murphy from NSIG, which can be found below:

Wnternetradiomercedes.com: Could you help me understand how the Nevada Sports Investment Group's Commission structure operates?

Ken Murphy: We refer to it as a 'Performance Fee,' which is paid out quarterly based on a high watermark principle, a standard term in the investment realm.

I can't present the details exactly as they were relayed to me, so let me explain the structure based on my notes. For instance, consider three quarters where an investor achieved a $5,000 profit in the first quarter, incurred a $2,000 loss in the second quarter, and saw an $8,000 gain in the third quarter:

| Quarter | Result | Performance Fee |

|---|---|---|

| First Quarter | $5,000 | $1,500 |

| Second Quarter | ($2,000) | $0 |

| Third Quarter | $8,000 | $1,800 |

One might ask, \"Isn\"t 30% of $8,000 $2,400?\"

However, NSIG works differently; the profits from the third quarter would be adjusted against the losses in the second quarter. As a result, the 'Performance Fee' would only apply to the net profit of $6,000 from those two quarters, translating into a fee of $1,800.

Additionally, following the fourth quarter, there is what Ken Murphy calls a 'True up.' This means that if there are losses in the fourth quarter, say another $2,000, then $600 of the fee paid on previous third-quarter profits would be returned to the investor’s account as an overpayment.

WoO: Your entity allows for withdrawals at any time despite a minimum investment of $25,000. Does this mean that an investor could potentially withdraw profits as they're generated?

KM: Our website indicates that we aim to process withdrawal requests within three days whenever feasible. Generally, we handle requests on the 'Same day,' though we do enforce a minimum withdrawal of $10,000.

WoO: Regarding that $10,000 withdrawal, can someone circumvent your $25,000 minimum by depositing that amount and then withdrawing to drop below the required balance, or must they maintain at least that amount continuously?

KM: The reason for our $10,000 withdrawal floor and not locking funds like some other entities is due to our understanding of our investors' short-term liquidity needs. Most of our clients are experienced investors, and the funds with us typically represent a small fraction of their extensive portfolios. For them, a $25,000 investment isn't substantial.

That said, we maintain the $25,000 minimum for a reason. We usually don't mind withdrawals reducing the balance below that threshold, but if it becomes a frequent pattern where individuals are continually depositing and withdrawing, we may reconsider our relationship with them.

WoO: For some, $25,000 could be a significant amount. Do you offer any options for individuals who cannot meet that amount?

KM: They absolutely can. The total investment just needs to be $25,000 or more. For instance, a group of five friends could each contribute $5,000 and create an LLC or Corporation to invest together. This entity would operate like a business and distribute any withdrawn funds as per their agreement.

However, keep in mind that all investors need to be approved individually, including each person involved in the LLC.

WoO: When you make investments for a specific game, are there different bet applications for various accounts, or does every single bet apply universally to all investors in the pool?

KM: We NEVER allocate investments differently among accounts. Every profit and loss is distributed proportionally according to each investor's share of the total pool on any given day. For example, if your investment represents 5% of the pool, you receive 5% of any net gain or loss.

WoO: How aggressive are you with investments? If an opportunity arises, what is the maximum percentage you might bet?

KM: We typically place bets that amount to about 1% of the total fund. Our strategy is conservative; on one occasion, we did make a 2% investment, which is published on our website.

http://www.sportsentitywagering.com/selection-archives/

I might consider up to 3% for a particularly advantageous situation, though I don't foresee ever exceeding that. Our aim is to focus on long-term returns, understanding that there will be periods of losses and even losing quarters. For instance, if we maintain a win rate of 60% over time, it implies we will still lose on four out of ten bets.

WoO: Is it accurate to say that investors have no input on which bets are made, and importantly, that out-of-state investors legally cannot make suggestions?

KM: That's correct. However, we can inform investors about our betting intentions prior to the games starting, although some entities may opt not to share this information with their clients. Interestingly, while some investors prefer to remain unaware and simply receive a monthly update, others do enjoy getting advance notice.

When it comes to my investment choices, I take full responsibility for 100% of them. I even have a fantastic handicapper on my Advisory Committee, and while we sometimes have private disagreements on certain investments, the final call rests entirely with me. For instance, when I traveled out of town in May to spend time with my grandchildren, we completely ceased all activities during that period.

WoO: Can you elaborate on how you select your picks? Is it purely based on analysis?

KM: Absolutely, I rely heavily on statistics and analysis when making selections. While it’s natural for everyone to have emotions, I strive to minimize their influence. For example, I recently placed a 2% bet against my favorite team. There are subjective elements and other aspects that statistics might not fully capture. Generally, if my feelings about the game and the analytical data conflict, I choose to refrain from betting on it.

Additionally, there are various plays that are fundamentally solid from a statistical standpoint. Just yesterday, we saw Santana facing Verlander in a match between the Minnesota Twins and the Detroit Tigers (7/20/2016), and we set a line for under five runs in the first five innings. Both pitchers are very capable, and I believed that if they managed to get through the first inning—despite both sides hitting solo home runs in that inning—the odds would favor a low-scoring game later on, which indeed turned out to be the case as the next seven innings were scoreless.

We also anticipated the total runs in the game to be under 9. I considered that if the starting pitcher performed well, the bullpen would likely hold up too. The bet seemed right after observing that the starters were on form.

WoO: What kind of reporting practices do you have? Are there tax implications to consider?

KM: We are committed to certified annual accounting, which includes a complete audit of our performance and financial standings. As part of this process, our investors receive an annual report every February, regardless of whether they decide to withdraw their funds; any profits will be taxed as gains.

WoO: At this point, CG Technologies is the exclusive sportsbook for placing your bets? Is there a chance they might choose to back off your organization, and is that even within their power?

KM: In the grand scheme, we're quite small compared to major players in the investment sector. Since we only risk 1% to 2% on any game, the profits we generate are relatively modest. There may be individual bettors who wager larger amounts on either side than we do collectively. Should we expand to a fund of forty or fifty million dollars where a 1% bet represents $400,000, I can see potential concerns from the sportsbook regarding accepting that volume of action.

This perspective is why I welcome competition; in fact, I don't even view others as rivals. I envision a scenario where more than one hundred entities emerge in the coming years, leading to a distribution of betting activity across various sportsbooks.

Currently, there is essentially one of each type. We have one sportsbook and only one bank that adheres to state regulations for our operations. Furthermore, we must confirm not only that an investor has sufficient funds but also the sources of those funds. Right now, the Bank of Nevada is our sole banking partner.

I genuinely hope that this sector gains wider acceptance, as it would result in more entities and sportsbooks entering the market. I suspect that while some will experience profitable quarters and years, others may struggle.

WoO: Precisely! If you know you're on the right side of a line, you’d probably prefer an entity to invest on the opposite side, wouldn’t you?

KM: It's not limited to entities; sportsbooks must also remain profitable for everything to function smoothly. Even if there was an entity backing the opposite side of my position, it's difficult to assert that one is definitively right or wrong. Statistical analyses and computational models provide insights, but ultimately, it boils down to subjective opinions.

That's a major reason why I'm optimistic about the emergence of more entities and sportsbooks willing to work with them. For example, if I favor a point spread of -2.5 but CG lists it at -3, I face a dilemma: either place a bet I believe is poor or abstain from betting altogether. Naturally, I will not risk a bet I think is bad. Another sportsbook might offer that game at -2.5 or even -2, and I would likely take that line for myself, even though I cannot act on behalf of the entity.

WoO: While a five-inning 'under' bet may not usually be classified as a prop bet, Wnternetradiomercedes.com has reported many favorable expected value prop bets for the Super Bowl. Do you foresee your entity engaging in such bets?

KM: There are a couple of reasons why we likely won't pursue those bets, even if I might personally choose a strong one: first, the betting limits are generally too low on prop bets to make them worthwhile from an equity standpoint; second, I view them as too speculative for the entity's involvement, so I doubt we will invest in them.

WoO: What, in your opinion, makes sports entities a smart investment choice overall?

KM: Currently, we are in the process of creating our historical legacy. Recently, we've seen positive trends over the last three and a half months, but I readily acknowledge that such a short timeframe isn't truly significant. Some people will choose to watch from the sidelines while others will seize the opportunity. I recall holding onto my Blackberry long after many made the switch to the iPhone, and once I upgraded, I couldn't believe I had stuck with the Blackberry for so long.

Our goal is to establish a legacy of sustained success over the long term, which will encourage more people to transition from the sidelines to invest—not only with us but potentially across the broader industry. While three and a half months can yield positive outcomes, true success over years is what I aim for to become an appealing option for virtually any investor, though there will always be uncertainties.

WoO: I consistently advise people to be wary of anyone who mentions, 'guarantee' in sports betting, whether it's your firm, a tout service, or anything else. It's best to steer clear!

KM: Absolutely, and I would never use that term because it's misleading. Our results in the past three and a half months have been favorable, but we've had a month of losses too. Winning isn't guaranteed; even a 60% win rate means losing four out of ten picks. Losses can occur over varying timeframes, whether it's a week, month, year, or even a lifetime. My objective is to build a track record that demonstrates our capacity to generate profits for investors, but I would never promise anything.

WoO: Do you have any recommendations for individual investors considering your firm compared to the competition?

KM: My recommendation is for investors to make the choices they believe suit them best. The key for anyone looking to invest is to conduct proper research and explore multiple entities that pique their interest. Different firms cater to diverse demographics; while most of my investors range from six to seven figures in total investments, there are other firms designed for those with smaller investment amounts.

Again, I wish there would be a hundred funds available since that would allow us access to additional sportsbooks, and provide every investor with the chance to find the entity that aligns with their needs. I firmly believe the numbers will show that betting through entities should be part of everyone’s investment portfolio.

When compared to the stock market, there are numerous external factors that can influence a company's stock value that aren’t directly related to the company's performance. These can include political changes, events like Brexit, interest rates, oil prices, or even a hedge fund short-selling a stock. Investing in stocks is frequently a long-term commitment.

There are thousands of stocks available, but I feel that sports betting offers more concentrated investment opportunities with quicker outcomes. In a league with thirty teams, there could be a maximum of fifteen games in a given day. If we choose just one game, investors will know the outcome when they wake up the next day, and it’s on to the next opportunity. The longest-term investment we might consider could be a point spread on an NFL game on a Monday that is played the following Sunday.

Moreover, this type of investment is highly liquid. An investor typically has most of their funds readily available at all times, avoiding the situation where money is bound in various investments. Since funds can be withdrawn at any time, this format offers very accessible cash for immediate needs, contrasting with the difficulties often faced in extricating funds from other investment forms.

WoO: Thank you for taking the time for this interview! It has been great talking with you today. Before we wrap up, could you share a few reasons why someone might choose to invest with your organization specifically…

KM: We pride ourselves on being professionally managed and maintaining open communication with our clients. While our fees might be among the highest, I believe we'll ultimately deliver the best net profits for our investors. Additionally, investors can access their funds anytime without facing any penalties.

WoO: Thank you again, Mr. Murphy.

____

In today's interview, we had the pleasure of speaking with Ken Murphy from Nevada Sports Investment Group. He provided a wealth of informative perspectives regarding Equity wagering and shared specific insights about his company. Many might find his arguments regarding the viability of Entity Wagering as a sensible inclusion in an individual's investment strategy quite compelling.

It's fascinating to note that an investment of $25,000 made on March 31, 2016, has appreciated to $31,531.26 by July 22, 2016. This remarkable figure translates to an impressive annual growth rate of 89.57%. Although it's crucial to emphasize that such short-term results shouldn't be taken as definitive predictors of future success, Mr. Murphy certainly highlighted NSIG's strong initial performance during our discussion!

I must also commend Mr. Murphy for being not just a true gentleman but also an exceptionally articulate communicator. Should you wish to listen to him on The Las Vegas Sportsline, you can find it via this link, reaching the segment at 31:10.

It's essential to clarify that this is not intended as promotion for NSIG, particularly for those readers who might not have the necessary capital to invest (minimum investment is $25,000) or may find it challenging to establish a partnership. Now, let’s take a moment to look into other available investment options.

Bettor Investments, operating out of Reno, Nevada, was among the pioneers in this industry. Unlike NSIG, they only require a minimum deposit of $500 to get involved. Their policy regarding fund growth includes monthly payouts or reinvestment, and they assert that they limit any single bet to a maximum of 2% of the total fund's value.

The management fees for Bettor Investments are also more favorable, as they charge a 15% fee, but this is contingent upon every month yielding positive returns.

However, it's worth mentioning that Bettor Investors appears to lack the same level of transparency in their results when compared to NSIG, as indicated on their website.

While they do share comprehensive monthly performance summaries, the specifics regarding individual game outcomes are only disclosed to active investors. They do provide a page demonstrating a Sample Return on Investment (RoI), but that doesn't necessarily reflect their overall performance or the significance of the Win/Loss Ratio presented to those not invested.

http://bettorinvestments.com/sample-roi/

I am not suggesting they are unprofitable; rather, I appreciate NSIG's approach of making their individual game picks accessible to everyone after the fact. For example, when you bet on teams with a high implied probability of winning based on the spread, you would expect a correspondingly high winning rate—potentially even overshadowing losses.

Additionally, there is Contrarian Investments, which began operating a few weeks later than the previous two firms. Unlike NSIG, they set their minimum deposit requirement at $1,500, though it's above the benchmark set by Bettor Investments. On the downside, they limit investors to only two withdrawal opportunities per year. For those who value quick liquidity, this makes Contrarian Investments a less attractive option.

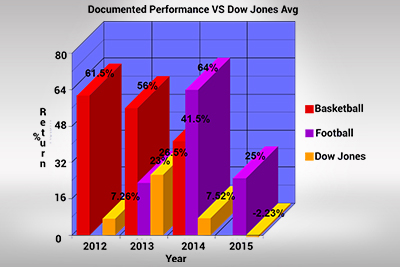

Moreover, they adopt a very conservative strategy and claim to limit their monthly plays, which may explain why they hold onto funds for extended periods. They also retain 20% of the profits above the high watermark and charge an initial deposit fee of $50. Interestingly, they compare their performance against the DOW Jones Industrial Index, demonstrating a notable outperformance over recent years.

http://contrarianinvestments.net/historical-performance/

If you prefer being actively engaged in betting, you may want to steer clear of Contrarian Investments, as they have only made six bets from mid-April to mid-June. Nonetheless, Chris Connelly has a proven track record, making this firm an appealing choice for those inclined towards conservative investment strategies.

Chris Connelly Interview

Additionally, I learned during an exclusive interview with Mr. Connelly that their focus leans heavily towards Football and Basketball, both at the collegiate and professional levels, while he refrains from placing bets against MLB Lines. This focus is another factor contributing to their limited number of selections this year. Here’s the complete interview with him:

WoO: I’ve covered some basics in a previous interview with Ken Murphy, so I hope you won't mind if I jump straight into specifics. Your firms differ significantly in that you allow investors to withdraw only twice a year. What’s the reasoning behind that?

CC: There are several factors at play. It's common for both investors and sports bettors to increase their bets after wins and decrease them after losses, so I want to prevent withdrawals based on individual game results. My investment strategy follows the Kelly Criterion and is linked to the fund's initial amount. Sudden withdrawals after a few outcomes might adversely affect that structure. I also encourage investors to refrain from increasing their stakes until the holding period concludes to avoid decisions influenced by short-term variance and a few consecutive wins. Additionally, I prefer not to devote too much time to processing transactions and paperwork; I aim to focus on identifying good picks. I want to avoid having someone question my choice of a long-shot team, like the Jaguars or 76ers when they don't win (even if my analysis suggested a positive expectation) and say, 'I need to pull my money out!' Each season is an intricate process.

WoO: You mentioned that while returns in dollar terms might not always be significant, the percentage returns have been exceptional.

CC: Absolutely, and it’s exciting to see a growing number of investors coming on board. Investors in any domain are typically very pleased with a 105% return over a few months, let alone what I’m currently achieving at around 19.5% this year. Personally, I wouldn’t be satisfied if my returns fell in the 5-10% range. A mere 5% return during a sports season would be disappointing to me, but of course, there's no certainty in this field.

WoO: What prompts you to set lower minimum deposits compared to an organization like NSIG?

CC: This approach is appealing to new investors who want to ease into things and test the waters. Although they could observe my results from the sidelines as I publicly share all performance data on our site, some wish to begin with a smaller stake. I do have certain investors who meet NSIG's minimum, but they've been following my progress for years and are already familiar with the expected results. There’s a subscriber who had been tracking my picks via email, and when I notified all followers about this new opportunity, he made an initial investment and later increased his stake after a few months.

WoO: It appears you make fewer selections than NSIG; what drives that difference?

CC: It's true; I tend to have a lower volume of picks compared to NSIG. My focus is strictly on Football and Basketball while they also include MLB in their offerings. By the time I got set up, the College Basketball season was over, football hadn't commenced, and I only had a few NBA playoff games that were viable for picking. My philosophy leans toward conservative play selection, aiming only for the top-value opportunities, which have been fewer since equity betting gained approval.

WoO: Your website states that you could risk as much as 5% of the fund on a single outcome, which exceeds the percentages some other firms are willing to commit; what's your reasoning?

CC: The objective for each bet is to identify the maximum limits relative to the fund, aiming for more flexibility beyond just 2-3% per outcome. According to the Kelly Criterion, an optimal average risk is about 5.3%, based on historical performance metrics of the types of outcomes I evaluate. Given the scarcity of highly favorable opportunities throughout the year, I wouldn't be comfortable capping my maximum percentage investment any lower than that.

WoO: Although you're prepared to take greater risks with a larger percentage of the fund, does the possibility of a losing season due to mere variance worry you regarding potential investors' perceptions?

CC: Last season, College Basketball was my worst-performing season ever, but the losses were counterbalanced by my strongest season in the NBA, which was rather ironic. Ultimately, I ended up profitable for the entire basketball season, and I have yet to experience a net loss in any sport over any season, reinforcing my confidence in my long-term performance. My history of picks is well-documented, which I hope reassures prospective investors.

WoO: How do the sports you bet on differ from Baseball?

CC: With the multitude of games played in baseball, I find the odds tend to be a bit tighter than I'd prefer. This might explain why many betting firms and individuals who engage in baseball betting usually don't risk as high a portion of their bankrolls. Ultimately, the results will play out over time, and we'll see how it unfolds.

WoO: Do you share Ken Murphy's view that you do not consider other investment entities as competition?

CC: Definitely, if sports betting becomes widely legalized across several states, it will lead to increased betting volumes, with investors becoming more inclined to invest larger sums. Our limits will rise along with that, allowing us to place more significant bets for our investors. I welcome the introduction of new players in the field, hoping for participation from less sophisticated bettors that might make poor line choices. Ideally, I would like to see other firms disagree with my assessment on certain bets and take opposite sides.

WoO: Do you have any worries that CG Technologies might reduce your limits or completely cease operations with you as a betting entity if you keep outperforming them?

CC: That was my primary concern when I began working with these entities. I was alerted at the same time to start placing bets, which is why I refrained from wagering during the initial weeks, even though I could have started alongside NSIG. I took two weeks to address these potential issues and I'm ultimately trusting CG to keep their word by allowing us to place larger bets and promising they won't decrease any limits; rather, they will only raise them in relation to our entities. While I would prefer higher limits, the current setup is workable for now. I'm moving forward based on their assurance to maintain the limits for entities.

WoO: What do you believe motivates CG Technologies to pursue this strategy?

CC: I suspect that legalized sports betting will become commonplace in a few years, and the bookmakers that accept entity betting will be able to operate in all states where sports betting has been legalized under S.B. 443. Additionally, I think there's a chance that they will leverage the knowledge gained from what we (the entities) produce to identify and rectify weak betting lines, which could ultimately save them money.

WoO: At what point do other entities start to pose a threat as competitors?

CC: I believe that the best will come to the forefront, and Contrarian Investments will likely be among the top, if not the very best. We also maintain a high level of transparency with both our investors and those interested in our results. I have reservations about the credibility of many individuals or their claims of success, particularly when they only showcase win/loss records. Winning percentages can be misleading—are you betting mostly on underdogs to maintain a high win rate while still ultimately losing money? Who can say?

WoO: Isn't it true that an investor could choose NSIG for their MLB investments since that's not your focus, but later return to you for investment opportunities in football or basketball?

CC: Definitely, if that's what they choose to do. I'm incredibly confident in my long-term performance, which is why I'm comfortable being completely transparent about my operations. Other entities may operate similarly, allowing investors the flexibility to engage with one entity during a particular season and switch to another or even invest with multiple entities at once.

WoO: Exactly, and isn't the underlying theme really about diversifying one's investment portfolio?

CC: Totally! In that context, my competition isn't just with the betting lines or other entities, but rather I need to exceed any alternative investment opportunities available to those individuals to ensure my success.

WoO: What makes Contrarian Investments the right choice for investors?

CC: I didn’t just come aboard recently; I have a proven track record of success over numerous platforms and many years. I have consistently been a long-term winner. Moreover, every selection I offer for the entity is backed by my own capital, so I am not simply gambling with someone else's money. My history of successful outcomes speaks volumes, and I trust it will continue in the same direction.

WoO: Thank you for your time, Chris.

Speaking with Chris Connelly was a genuine pleasure, and it was enlightening to hear his insights. I'm not going to share personal opinions regarding any involvement with them, but I feel the concerns I had about the organization beforehand were thoroughly answered during our discussion.

Hi-Line is a fund that focuses solely on MLB betting, which means that investors looking to engage in other sports may have to collaborate with multiple entities. Unlike Contrarian, Hi-Line does not enforce a lockdown on investments and requires a minimum investment of only $1,000. Additionally, similar to Contrarian, they impose a Performance Fee of 20% at withdrawal or the conclusion of the MLB season. Hi-Line has a more aggressive approach compared to others, willing to stake as much as 5% of the overall fund on a single game, and they can have up to 20% of the fund at risk at any given time.

Hi-Line is managed by Beau Noeske, and at the time this was written, their website offers perhaps the least amount of information compared to other entities.

http://hi-linesportsinvestment.com/

The four entities mentioned earlier are presented by WagerTrader.com. I had the chance to talk with Todd, the owner of WagerTrader.com, who shared his perspective on the new landscape of this industry.

WoO: You seem to be at the forefront of guiding people to various entities; are you feeling optimistic about the future of Entity Wagering?

Todd: This thing is going to blow up, man!

WoO: What's the ultimate goal for your site? Are you generating any revenue or acting as an affiliate for the entities you're currently listing?

Todd: Currently, I'm not making any profit from it, but my expenses are minimal—around $2 daily. I view this as an investment rather than just a free venture, as I'm aiming to position myself for potential employment with one of these entities or to establish a different business connection.

WoO: Do you foresee an opportunity in becoming an affiliate? Ken Murphy from NSIG suggests there could eventually be up to 100 entities, so linking people to the right entities might yield some earnings for you, especially as an early resource?

Todd: I can see that being a possibility. There are many legal complexities that remain unresolved, and I think positioning myself as an exchange platform, if I can figure out how to do that, is another option. What I do know is that this could balloon into something significant, and I want to carve out a place for myself, whether by working for an entity, facilitating exchanges, or by having my site flourish independently.

WoO: Are you currently investing in any of these entities? If yes, which ones?

Todd: I really don't gamble on sports much at all. Occasionally, on a Saturday, I might visit (name of casino intentionally omitted) with friends for some Blackjack. That's pretty much it; I lack extensive knowledge about sports betting.

WoO: It appears many of these entities are generating positive early returns. Do you think that people will eventually gravitate towards them, even if they're based in Nevada? Additionally, do you believe the Sportsbooks might try to suppress their activity if they win too frequently?

Todd: From my perspective, a lot of individuals just seek out action and don't mind much about what side they’re backing unless it's their favorite team. Having some stakes makes the game more entertaining even when you’re not picking sides directly.

WoO: That's especially valid if these entities can demonstrate a consistent history of wins, right? Personally, I tend to hover just above a 50% success rate against the spread, not enough to overcome the vig—would I rather trust an entity with a higher win rate versus relying on my lackluster picks?

Todd: (Laughing) Exactly! Some individuals just want to be part of the action. You'll have a stake in the outcome, which likely improves your chances over time. I genuinely believe this could evolve into a serious investment avenue, with some individuals allocating substantial portions of their portfolios to Sports Entities. When it comes to individual matches, these entities keep you informed about your bets shortly after the betting period closes, making the game more exciting for you.

WoO: Do you think Sportsbooks might eventually refuse to accept action from certain entities due to their success rate?

Todd: Remember, Sportsbooks don't always lose on the opposing bets, as you know. Their primary goal is to maintain balanced action. So, whether an entity wins or loses might not matter much as long as they can line up sufficient bets on the opposite side, and moreover, they might utilize entity betting behavior as a signal to adjust their lines accordingly.

WoO: I understand now, similar to setting a -2.5 spread on one side and a +2.5 on the opposite, if they get $20,000 bet on each side, they profit regardless of the outcome and likely won't have an immediate reason to care about which side is winning—correct?

Todd: Exactly, they don't position themselves against entities or individual bettors per se. Their main focus is to manage the action in such a way that ensures profit for themselves, regardless of the outcomes.

WoO: Who has displayed the greatest interest in your site so far?

Todd: While some individuals overlook the importance of Google Analytics, I find it quite informative. I notice that a significant portion of my website traffic originates from New York, particularly among those interested in investment vehicles like Mutual Funds and Hedge Funds. This leads me to believe that, barring any major controversies, investing in these areas will grow in popularity over time. The potential returns are remarkable if the current trends persist. Achieving a 20% gain in just three months is nearly impossible in the Stock Market without taking immense risks on a few selected stocks and relying on luck. If these groups can keep delivering such impressive returns, I genuinely feel this will evolve into a formidable investment approach.

WoO: In states where Sports Betting remains illegal, which is true for the majority, this provides a legitimate avenue for individuals to participate in betting. Do you believe that those who long to bet on sports will find this option enticing?

Todd: As you mentioned, if these organizations can demonstrate consistent winning records, people would likely prefer investing their money with those who have proven capabilities. Additionally, I am convinced that many people are indifferent to the specifics of their bets as long as they have the thrill of engaging in the action.

I'm from Hawaii, where, as you noted, any form of legalized gambling is nonexistent. However, I recall a friend's house where five Poker tables were set up specifically for playing—nothing else happened there. This clearly indicates a strong desire to gamble, even when it's prohibited. Nevertheless, I believe that if legal alternatives are available, most individuals would prefer to stay within the boundaries of the law whenever possible, opting for legal gambling options when they arise.

WoO: Recently, I had a conversation with Ken Murphy, who predominantly refers to this activity as 'Investing.' He appears to avoid using the term 'Gambling' deliberately.

Todd: Essentially, every form of investment can be seen as a gamble, whether or not it involves Sports Betting.

WoO: I concur. Thank you for sharing your thoughts, Todd. Wishing you the best with your website!

___

Another organization worth mentioning is BlueChipsSA.com, which stands for Blue Chips Sports Advisors. They currently implement a performance fee of just 10% and stipulate a minimum investment of $1,000, which they plan to increase to $5,000 over time. In addition, they charge a management fee of 2% based on the initial deposit, which means investors could incur losses yet still owe that 2% fee on their investment.

Moreover, they require investors to lock in their funds for one full season, preventing any withdrawals whenever desired. This organization estimates that the typical duration of an investment will span between two to four years. Unfortunately, I couldn’t locate specific detailed results regarding individual selections on their website. However, the available PDF mentions that they might allocate somewhere between 0.5% to 2% of the total fund, contingent upon the perceived value over the odds displayed.

Additionally, this organization seems cautious about taking on too many games, reflecting a 13-4 record based on their hypothetical bets from the 2014 and 2015 MLB seasons.

Reportedly, there are currently up to nine licensed firms in operation, so I encourage you, the reader, to explore and gather information on any others that might pique your interest.

___

Frequently Asked Questions:

Let’s dive into some Frequently Asked Questions that might arise for our readers before addressing more opinion-driven topics and additional information:

1.) Can anyone be an investor?

Answer: The short answer is both yes and no. In theory, anyone from any part of the United States or in various global locations (subject to individual country laws) could step into the role of an investor. However, existing legislation necessitates general Know Your Customer (KYC) procedures regarding the funds deposited by clients. This is primarily because Nevada aims to prevent these activities from being misused for money laundering or facilitating the usage of illicit funds and identities. Essentially, they want to ensure all investors are engaging in lawful activities.

2.) Will I pay taxes?

Answer: If you are fortunate enough to win, you will receive an annual statement detailing your earnings, on which you will be liable to pay taxes, similar to any other form of profit. It's worth noting that all gamblers and investors are actually required to report any gambling profits for tax purposes; however, it's true that casual bettors may often overlook this responsibility.

3.) Is This a, 'Safe,' Investment?

Answer: In a nutshell, you’re placing your investment based on the belief that a Sports Betting agency can make successful bets that yield a positive return for you. Thus, it's a somewhat complex issue. Your investments should generally be regarded as 'safe' due to the plethora of compliance regulations ensuring the proper management of investor funds, alongside detailed monthly and yearly reports. Furthermore, each entity must maintain a comprehensive record of their betting history and results, which must be made available to Nevada state authorities upon request.

As far as guarantees of financial returns go, absolutely not. You're investing with the hope of achieving gains, but it's certainly not assured.

4.) Will I be charged anything if my investments do not yield success?

Answer: It can vary based on the organization. Looking at the entities we've reviewed so far, one imposes a $50 deposit fee, while another has a 2% 'Management Fee' on total deposits, although their performance fees are lower compared to others.

5.) Who is Making the Bets?

Answer: While the entity handles the betting, it’s important to note that, in several instances, only one person, whom we can describe as the 'Decision-Maker,' determines what bets will be placed for investors. Thus, your investment's success is largely tied to that individual's capability, and fortunately, initial outcomes suggest some of these decision-makers have performed quite well!

6.) Am I permitted to instruct the Entity on what bets to place?

Answer: Not at all. For starters, the WIRE Act prohibits the transmission of Sports Betting information between states, and legally, an individual cannot place a sports bet unless they are physically present in a state that permits it. Remember, in this context, you aren’t the one placing bets; the entity is acting on your behalf using your funds. Even if it were legal to discuss betting strategies with them, it’s unlikely they would act on your suggestions. If you had as much expertise as they do, you would likely be better off going to Nevada and betting on your own.

7.) What is the minimum investment amount to start?

Answer: This varies by entity but typically ranges from $500 to $25,000 as a minimum deposit. Notably, several companies with lower deposit thresholds hint at plans to increase the minimums after one or two successful seasons. Additionally, in some cases, multiple individuals can establish a partnership, corporation, or LLC that invests collectively with certain entities, but each individual involved must still gain approval as investors.

8.) How many entities are there?

Answer: As of now, there are nine licensed entities operational, but it is anticipated that more licenses will be issued in the near future, which will likely result in an increased number of entities emerging.

9.) How do I select an entity to invest on my behalf?

Answer: Choosing to invest is fundamentally a personal decision based on identifying an entity whose investment strategy aligns with your own financial objectives. Some organizations will only engage in betting on a particular side of a line if they believe they possess a significant advantage, while others may engage more broadly with numerous less advantageous picks. Additionally, many entities focus exclusively on specific sports or a limited range of sports, so you can evaluate various organizations and select one with a strong track record in the sport where you wish to invest.

In my view, my initial focus would be on finding entities that don’t require much, if any, money upfront. My preference would lean towards entities that gain profit only if I do, which raises concerns about those that charge a 2% 'Management Fee' on all deposits. For example, if I deposited $5,000, they would earn $100 from me, regardless of their performance on my bets.

____

Regarding overarching concerns, one primary issue that worries investors, as well as the nascent industry as a whole, is the potential for a high-profile scandal to tarnish the entire sector. This is why regulatory bodies are being particularly meticulous in granting licenses to operate within this realm. A single case of mismanagement of client funds or failure to process withdrawal requests in accordance with established terms could cast a long shadow over the entire industry.

Another concern pertains to CG Technologies, which currently stands as the sole Sportsbook allowing entity betting, resulting in entities being constrained to a single set of betting lines. Certainly, these entities aspire for a broader range of betting lines to choose from, but that is not the present reality. As more Sportsbooks (hopefully) begin accepting bets from entity groups, theoretically, these groups will be bolstered by having access to a wider variety of lines that they can potentially surpass.

Nevertheless, I don’t believe this alone should dismiss the concept of Equity Wagering. No sportsbook can deliver perfectly efficient lines without any advantage, meaning there will still be advantageous opportunities for Equity firms to capitalize on. If we regard the performance of certain organizations currently in operation as indicative, CG Technologies has already revealed lines that are indeed beatable, and those lines have been successfully exploited.

In addition, I think it's crucial to prioritize companies that demonstrate a high level of transparency when disclosing their performance data. As discussed during various interviews, simply winning games isn't the most significant factor (since one could easily choose a top contender) – what's really vital is the actual financial outcome. Early on, these companies face the risk of jeopardizing their reputations by sharing short-term results, as fluctuations in performance might negatively affect them, leading to what could be misinterpreted as a serious downturn by potential investors. So while their fundamental strategies may be sound, initial outcomes might not align with expectations.

On the other hand, there is a chance that an entity may appear more capable than it genuinely is by achieving great success in its initial stages. This can often be attributed to the limited amount of data available, meaning that a group with superior algorithms or forecasting capabilities may initially have a reputation that doesn’t do justice to their true potential, unlike a presumably less competent competitor.

Many organizations indeed fall short in providing comprehensive insights into their methodologies for spotting weak betting opportunities. However, being overly specific about their strategies may pose challenges; if they reveal the exact process for making selections (or share their source code), individual investors could just bypass the company and place bets independently, effectively eliminating the intermediary. Therefore, these businesses must maintain a balance between being forthcoming and protecting their proprietary approaches.

Conclusion:

While there may be noticeable parallels between Equity Wagering and traditional betting advisory services, I would argue that key distinctions exist as well. For instance, if I were to weigh the prospect of investing in such entities, I would lean toward those with minimal or no entrance fees or management costs. Any funds paid as fees must eventually be accounted for as part of the investor's profits, especially when performance fees are factored in. Investors must also grasp how performance fees are structured and whether they could become unavoidable sunk costs. Companies such as NSIG, for instance, seem to have a policy of potentially refunding some fees after losing quarters due to their unique true-up framework.

Like any investment scenario, it's essential to thoroughly comprehend the terms and conditions, assess the percentage that initial \"Deposit Fees\" or \"Management Fees\" represent in relation to your investment, and determine the benchmarks the entity needs to hit to potentially recover those costs.

Getting involved in Equity Wagering carries its own risks, particularly because most entities won't have a long-term track record exclusively showcasing their results spanning several years. Yet, this situation also opens doors for early investors, especially those interested in entities with lower minimum deposit thresholds compared to others. The expectation is that the results will eventually validate their confidence in achieving long-term profitability, allowing them to raise their minimum deposit requirements over time due to the laws of supply and demand.

A noteworthy amount has already been committed, but this pales in comparison to the influx of investments that could follow if these companies prove their effectiveness. For example, during a radio interview, Ken Murphy from NSIG mentioned that the total investment at that point was in the mid-six figures, a figure he confirmed earlier. While a $25,000 investment is significant for many readers, it remains small compared to amounts typically seen in the Stock Market.

Certainly, if these entities demonstrate their viability, there's a high probability that more funds will flow in as investors look to benefit from promising returns. The most prudent approach would be to wait for several years of performance data before investing with the entity you deem most trustworthy, although doing so might mean missing out on attractive deals available now.

Moreover, not only could the minimum deposit requirements rise with the establishment of a proven track record, but fees may also increase, including potential hikes in \"Performance Fees\" as a percentage. Consider this: even if an entity boasts a near-certain chance of generating profits and decided to hike its Performance Fees to 50%, investors would still stand to gain given the near guarantee of profitability over a set period.

We have analyzed two entities that have yielded approximately 20% returns to their investors since inception. Even assuming both entities charged 20% in fees, an investment of $25,000 could grow to $30,000 with $1,500 in fees deducted, resulting in a net profit of $3,500 (a 14% gain) within just a few months. These companies might just be experiencing excellent early performance, but if they are merely achieving expected outcomes, the returns are significantly remarkable.

Although this opportunity may seem like a classic high-risk, high-reward scenario, it’s actually less daunting than it appears. If you examine a firm that typically invests 1% on a given outcome, and that exposure is distributed fairly among all investors, an investment of $25,000 translates to personally risking only around $250 on that particular outcome. Even for a group like Contrarian, which will risk up to 5.5% of the total fund, an investor would foreseeably only risk $1,375 on a $25,000 investment in a specific outcome. For some, that risk may feel excessive, while for others, it may feel insufficient if they prefer that all of their capital is actively engaged at all times.

Accessibility of funds in liquid form is another important consideration for many potential investors, and it’s beneficial for them to seek out funds that allow for withdrawals at any time without incurring penalties.

No matter the outcome, this intriguing new concept is one we plan to follow closely on Wnternetradiomercedes.com and throughout our wider network of sites. We anticipate producing additional related content in the future. If you have any inquiries or feedback, please reach out via PM to Mission146 or send comments related to the smaller connected article on WoV. LatestCasinoBonuses Mathematically accurate strategies and insights for casino games such as blackjack, craps, roulette, and hundreds of others are available for play. WizardofVegas.com Kindly check your email and click on the link we have sent you to finalize your registration.