On this page

The Kelly Criterion

On this page

Introduction

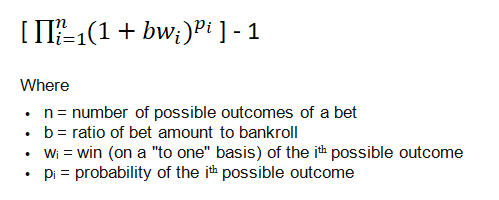

The Kelly Criterion serves as a strategic approach to determining bet sizes that effectively balances potential risks with expected rewards for gamblers making informed decisions. This technique can similarly be applied to any investment with the prospect of generating profit. For a gambler or investor with a typical level of luck, managing a consistent bet size, the anticipated growth of their bankroll after placing a single bet would be:

For instance, imagine a casino running a special promotion in craps where a roll of 2 pays out at 3 to 1 and a roll of 12 pays 4 to 1. Rolls of 3, 4, 9, 10, or 11 pay even money at 1 to 1, while all other outcomes result in a loss. The chances of rolling a 2 or a 12 stand at 1/36 each, while the likelihood of achieving an even money win is 14/36, leaving a loss probability of 20/36. If we further assume that the player wagers 1% of their total bankroll each time, we can compute the expected growth of their bankroll for each bet as follows:

(1 + (0.01*3))^(1/36) * (1 + (0.01*1)^(14/36) * (1 + (0.01*-1))^(20/36) * (1 + (0.01*4))^(1/36)) - 1 = 0.00019661.

Employing the Kelly criterion for betting yields a maximized outcome. This strategy also minimizes the anticipated number of bets needed to double the bankroll since the size of each bet is consistently proportional to the current bankroll.

The amount calculated using the Kelly method represents the best possible bet to enhance expected bankroll growth for an average lucky gambler. While wagering more than the Kelly amount may yield higher expected benefits per each bet, it introduces so much volatility that the long-term growth of the bankroll tends to suffer, especially when compared to sticking to the precise Kelly bet sizing. Betting at double the Kelly amount leads to no growth in expected value, while exceeding that figure results in a decline of the bankroll. Conversely, many gamblers often choose to wager less than the full Kelly amount. Although this approach reduces expected growth, it also contributes to lower volatility in the bankroll. For instance, placing half the Kelly amount as a bet can reduce volatility by 50%, but it only limits growth by a quarter.

For straightforward bets with two possible outcomes, the ideal Kelly wager is calculated by dividing the advantage by the payout odds expressed on a 'to one' basis. In scenarios involving multiple potential outcomes, the optimal Kelly stake is determined by maximizing the logarithmic value of the bankroll post-wager. However, as one might expect, determining this for multiple outcomes can be complicated. Most gamblers lean toward using a ratio of advantage to variance as a useful estimation, which tends to be quite accurate. For example, if a bet demonstrates a 2% advantage alongside a variance of 4, an individual employing 'full Kelly' would calculate a wager of 0.02/4, amounting to 0.5% of their bankroll for that particular event. It’s pertinent to note that variance is derived from the square of the standard deviation, which is often provided for many games that I mentioned. Game Comparison Guide .

Poland Recommended Online Casinos

Poland Recommended Online Casinos

120 % up to

1200zł

+50 spins

Welcome bonus package

Loyalty Program

Massive prize pools in slot tournaments

100 % up to

400zł

+120 spins

Minimum deposit and withdrawal thresholds are quite accessible

Support is extended for major traditional and crypto-currencies

Live games

Let’s look at three examples.

Example 1: A card counter identifies a 1% edge at a specific count. Referring to my Game Comparison Guide, the standard deviation for blackjack stands at 1.15 (this can differ based on both the rules and the count). Thus, with a standard deviation of 1.15, the variance becomes 1.3225.2= 1.3225. The portion of bankroll to bet is 0.01 / 1.3225 = 0.76%.

Example 2: A local casino is running a promotion offering 5X loyalty points in video poker. Typically, the slot club rewards 2/9 of 1% in complimentary play. Therefore, at 5X, the slot club contributes 1.11%. The optimal game is 9/6 Jacks or Better, boasting a 99.54% return rate. After factoring in slot club points, the total return rates rise to 99.54% plus 1.11%, amounting to 100.65%, which indicates a 0.65% advantage. According to the Game Comparison Guide, the standard deviation of the 9/6 Jacks or Better is recorded at 4.42, leading to a variance of 19.5364. Hence, the proportion of the bankroll to be wagered would be calculated as 0.0065 / 19.5364 = 0.033%. Notably, this specific promotion was active at Wynn during September 2 and 3, 2007.

Example 3: Consider a sports bet that carries a 20% chance of winning, with returns of 9 to 2. The formula for determining the advantage amounts to 0.2 times 4.5 added to 0.8 times -1, culminating in an advantage of 0.1. Consequently, the optimal wager according to the Kelly model would calculate to 0.1/4.5, equating to 2.22%.

Here is the precise calculation derived from example 3. Let 'x' represent the best Kelly bet, assuming a bankroll of 1 before placing the wager. The anticipated logarithm of the bankroll after the wager is...

f(x) = 0.2 × log(1+4.5x) + 0.8 × log(1-x)

To identify the maximum of f(x), we differentiate and set the result to zero.

f\"(x) = 0.2 × 4.5 / (1+4.5x) - 0.8 / (1-x) = 0

0.9 / (1+4.5x) = 0.8/(1-x)

0.9 - 0.9x = 0.8 + 3.6 x

4.5x = 0.1

x = .1/4.5 = 1/45 = 2.22%

The calculations become considerably more complicated when multiple possible outcomes are involved, as encountered in video poker. Though the approach remains the same, solving for 'x' is more challenging in such cases. I propose that the simplest way to navigate this challenge is by experimenting with various values systematically to find where the second derivative, f\", approaches zero, akin to techniques applied in games like the Clock Game on 'The Price is Right.'

I applied this methodology across two well-known video poker variants that yield over 100% returns. In '"," with a return rate of 100.76%, the advisable bet size comes to 0.0345% of the bankroll. Conversely, in '"," with a return of 100.17%, the optimal bet size is calculated at 0.0062637% of the bankroll. It's worth mentioning a common rule of thumb suggesting that to truly succeed in video poker, an individual should ideally have a bankroll that is three to five times the royal amount they aim for. For playing Full Pay Deuces Wild, the precise necessity is 3.66 royals, while for 10/7 Double Bonus, it's about 19.96 royals. Full Pay Deuces Wild To substantiate my assertion that the Kelly strategy reduces the number of bets needed to double the bankroll, I considered an even-money bet with a winning probability of 51%, providing a 2% edge, along with a 2% Kelly stake. Here's a breakdown of the average number of bets needed to double the bankroll at varying bet sizes. Should a winning bet exceed double the bankroll, the bettor would only wager what is required to precisely achieve that doubling. 10/7 Double Bonus Kelly Compared to the Best Video Poker Approaches

Simulations

I proposed that a bettor following the Kelly strategy might occasionally diverge from the optimal strategies for video poker. My rationale behind this perspective is detailed further.

Average Bets to Double Bankroll

| Bet Size | Average Bets |

|---|---|

| 0.5% | 7,901 |

| 1% | 4,617 |

| 2% | 3,496 |

| 3% | 4,477 |

Recommended Online Sportsbooks in Poland

In my Sep. 20, 2007 Ask the Wizard column A valuable resource concerning the Kelly criterion, particularly its application to blackjack, can be found in

Accurate mathematical strategies and information applicable to various casino games, including blackjack, craps, roulette, and countless others.

Accurate mathematical strategies and information applicable to various casino games, including blackjack, craps, roulette, and countless others.

View All

Links on Kelly

Fortune’s Formula by William Poundstone. Read my review .

Casino Gambling for the Winner

Explore the Top Online Casinos Available in Your Region Blackjack Attack by Don Schlesinger.

The Kelly Criterion at Wikipedia .